wake county nc sales tax breakdown

Did South Dakota v. North Carolina Department of Military.

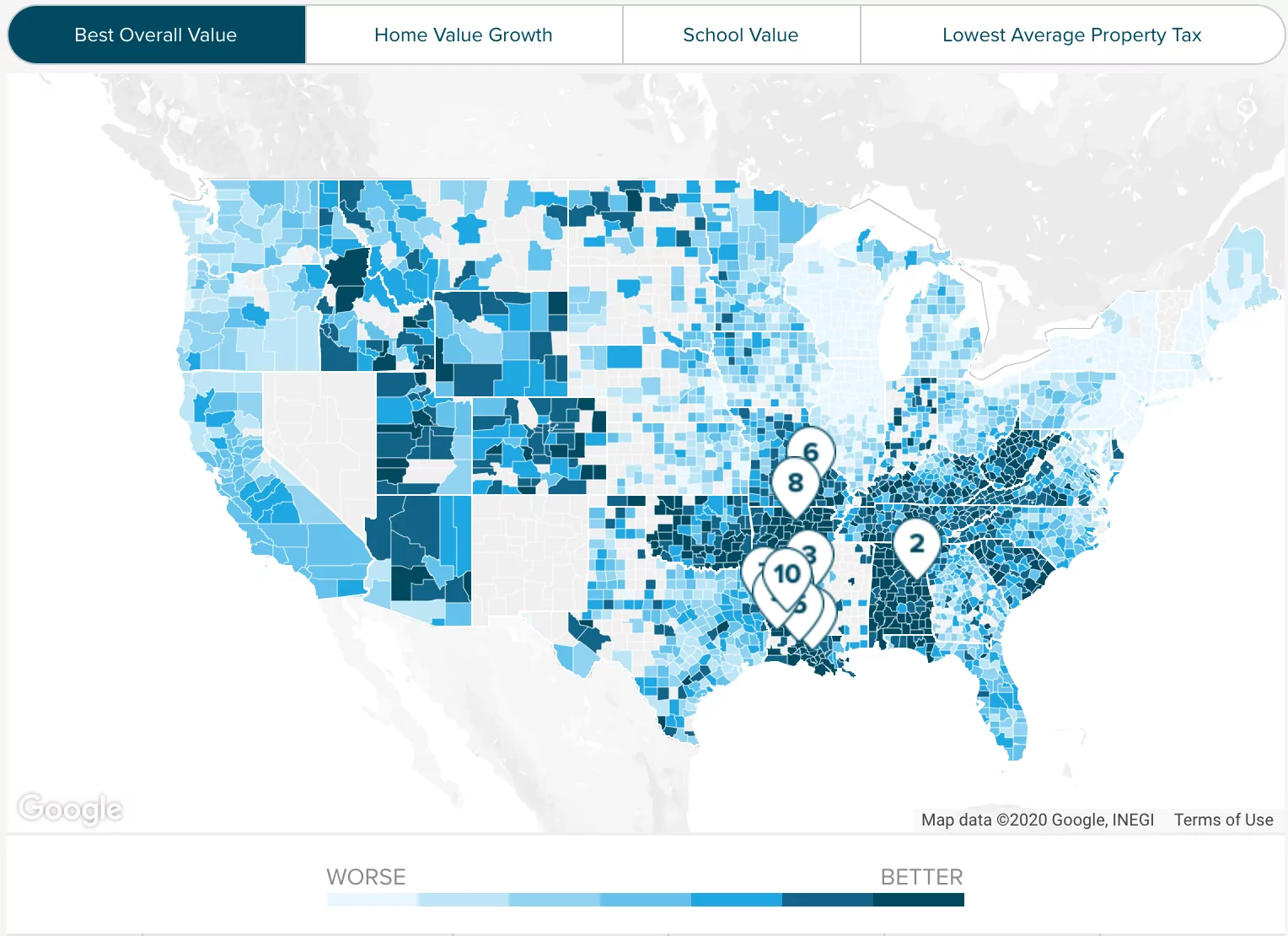

Wake County Nc Property Tax Calculator Smartasset

This tax is collected by the merchant in addition to NC.

. Get the benefit of tax research and calculation experts with Avalara AvaTax software. Apex NC Sales Tax Rate Apex NC Sales Tax Rate The current total local sales tax rate in Apex NC is 7250. This takes into account the rates on the state level county level city level and special level.

Sales Tax Breakdown Wake Forest Details Wake Forest NC is in Wake County. 2020 rates included for use while preparing your income tax deduction. State Sales Tax and is remitted to the County on a monthly basis.

Wake County North Carolina Sales Tax Rate 2022 Up to 75 The Wake County Sales Tax is 2 A county-wide sales tax rate of 2 is applicable to localities in Wake County in addition to the 475 North Carolina sales tax. Ad Avalara AvaTax can help you automate sales tax rate calculation and filing preparation. The minimum combined 2022 sales tax rate for Wake County North Carolina is.

Prepared Food and Beverages This tax is applicable to all prepared food and beverages sold at retail for consumption on or off the premises by any retailer with sales in Wake County that are subject to sales tax imposed by the State under GS. Learn about listing and appraisal methods appeals and tax relief. The December 2020 total local sales tax rate was also 7250.

Wake County is located in North Carolina and contains around 14 cities towns and other locations. Sales Tax Breakdown Raleigh Details Raleigh NC is in Wake County. Did South Dakota v.

Proof of plate surrender to NCDMV DMV Form FS20 Copy of the Bill of Sale or the new states registration. This includes the rates on the state county city and special levels. The average cumulative sales tax rate in the state of North Carolina is 694.

Any municipal vehicle tax assessed in accordance with NC General Statute 20-97 is not subject to proration or refund. The department also collects gross receipts taxes. Wake County NC Sales Tax Rate Wake County NC Sales Tax Rate The current total local sales tax rate in Wake County NC is 7250.

Wake Forest is in the following zip codes. This is the total of state county and city sales tax rates. The Wake County sales tax rate is.

The Wake County sales tax rate is. Click any locality for a full breakdown of local property taxes or visit our North Carolina sales tax calculator to lookup local rates by zip code. 2022 North Carolina Sales Tax By County.

The Wake Crossroads sales tax rate is. This is the total of state county and city sales tax rates. The latest sales tax rate for Wake Forest NC.

View statistics parcel data and tax bill files. The average cumulative sales tax rate between all of them is 725. The Wake Forest sales tax rate is.

Raleigh NC Sales Tax Rate The current total local sales tax rate in Raleigh NC is 7250. 27601 27602 27603. County Sales Tax information registration support.

The North Carolina sales tax rate is currently. The most populous county in North Carolina is Wake County. Wake Forest NC Sales Tax Rate The current total local sales tax rate in Wake Forest NC is 7250.

Sales and Use Tax Rates Total General State Local and Transit Rates County Rates Items Subject Only to the General 475 State Rate Local and Transit Rates do not Apply Items Subject to the 7 Combined General Rate Items Subject to a Miscellaneous Rate Sales and Use Taxes Imposed in Addition to the Rates Listed Above Other Information. The minimum combined 2022 sales tax rate for Wake Forest North Carolina is. Ad New State Sales Tax Registration.

This is the total of state and county sales tax rates. As for zip codes there are around 60 of them. Wake Forest is located within Wake County North Carolina.

35 rows Wake. The Wake County Department of Tax Administration appraises real estate and personal property within the county as well as generating and collecting the tax bills. There is no applicable city tax.

Within one year of surrendering the license plates the owner must present the following to the county tax office. The North Carolina sales tax rate is currently. Raleigh is in the following zip codes.

Within Wake Forest there are around 2 zip codes with the most populous zip code being 27587. As far as all counties go the place with the highest sales tax rate is Durham County and the place with the. Wayfair Inc affect North Carolina.

3 rows Wake County NC Sales Tax Rate. Wake County Public Libraries 919-250-1200. North Carolina has state sales tax of 475 and allows local governments to collect a local option sales tax of up to.

The December 2020 total local sales tax rate was also 7250. This is the total of state and county sales tax rates. This rate includes any state county city and local sales taxes.

2022 North Carolina Sales Tax By County. Wayfair Inc affect North Carolina. 3 rows Sales Tax Breakdown.

The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina state sales tax and 250 Wake County local sales taxesThe local sales tax consists of a 200 county sales tax and a 050 special district sales tax used to fund transportation districts local attractions etc. Sales Tax Breakdown Apex Details Apex NC is in Wake County. The 2018 United States.

PO Box 25000 Raleigh NC 27640-0640. The most populous location in Wake County North Carolina is Raleigh. Pay tax bills online file business listings and gross receipts sales.

The County sales tax rate is. The December 2020 total local sales tax rate was also 7250. The North Carolina state sales tax rate is currently.

Some cities and local governments in Wake County collect additional local sales taxes which can be as high as 075. The latest sales tax rate for Wake County NC. The 2018 United States Supreme Court decision in South Dakota v.

A full list of these can be found below. Register for Emergency Notifications. The average cumulative sales tax rate in Wake Forest North Carolina is 725.

Search real estate and property tax bills. The County sales tax rate is.

/https://s3.amazonaws.com/lmbucket0/media/business/capital-blvd-stadium-dr-4806-1-5cHYchll5gqCzmnjHrQSEM1AsLGMTuGPT9jOTR1wk2k.b02d4054bef2.jpg)

T Mobile Capital Blvd Stadium Dr Wake Forest Nc

Wake Forest North Carolina Nc 27596 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Wake Forest North Carolina Nc 27596 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Wake County Covid Cases Wake Forest Raleigh Cary Holly Springs Wral Com

Wake Forest North Carolina Nc 27596 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Wake County Nc Property Tax Calculator Smartasset

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Kevin Martini Certified Mortgage Advisor Martini Mortgage Group

Wake Forest North Carolina Nc 27596 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

North Carolina Sales Tax Rates By City County 2022

Homeowner Owners Could Be Pay More As Tax Hikes Are Proposed In Wake Raleigh Budgets Firefighters Rally For Pay Increase Abc11 Raleigh Durham

Wake County Restocking Free N95 Masks On Tuesday Wral Com

Wake County North Carolina Property Tax Rates 2020 Tax Year

Wake County North Carolina Property Tax Rates 2020 Tax Year

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More